It’s no secret that insurance companies charge much higher rates to cover wood frame buildings than buildings made with masonry, concrete, or other non-combustible materials. In fact, they typically charge 7-10 times higher rates for low and midrise wood buildings. Now, in some parts of the world, new advances in engineered wood, or mass timber, allow wood buildings to reach skyscraper heights. Are insurance rates still sky-high for mass timber buildings? Read on to find out.

Is Mass Timber Distinct from Conventional Wood Frame Construction?

To reduce insurance costs, industry stakeholders have made strong efforts to reclassify mass timber as distinct from conventional wood frame construction. Researchers have tested how mass timber buildings stand up to extreme weather, fire, and water damage. Based on these findings, fire and building codes have been adjusted to make it easier to use mass timber products.

Despite these efforts, insurers have been doubtful about lowering insurance premiums for mass timber buildings. Although mass timber now represents a segment of the construction market, insurance providers believe mass timber buildings present a greater risk than buildings constructed with concrete/masonry.

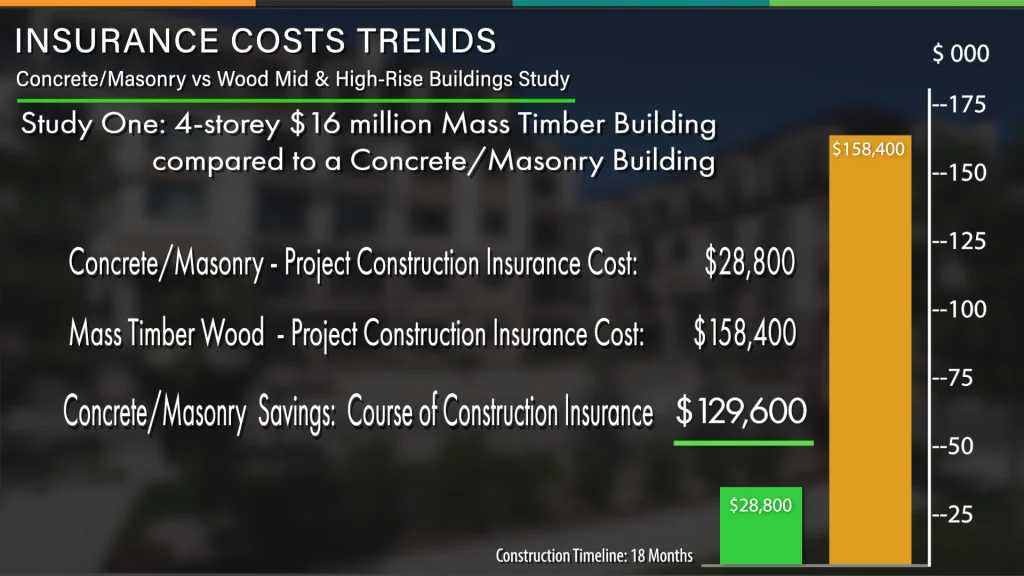

One case study compared a 4-story concrete/masonry building with a similarly sized mass timber building. The construction of both buildings took about 18 months to complete.

- The insurance costs of concrete/masonry building were $28,800

- The mass timber building racked up $158,400 in the course of construction insurance costs.

The savings in insurance costs alone were $129,600 in favor of concrete/masonry projects.

Is Mass Timber as Safe as Concrete?

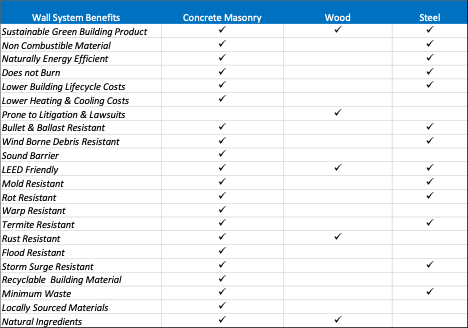

Concrete/masonry has always been safer than wood. Some claim that building with mass timber is faster, cheaper, and more eco-friendly than concrete/masonry or steel.

But is it safer?

Wood burns until it is extinguished—unlike concrete and steel. Because of its flammability, the insurance industry has rejected pressure to lower insurance rates on mass timber structures. Insurance costs for tall mass timber buildings are still 5-7 times higher than their concrete/masonry counterparts.

Another reason to maintain high insurance rates is the danger of property damage. In the event of a fire, mass timber buildings burn slowly enough to allow residents to escape but it will still completely burn. Fire will eventually breach compartments causing massive damage to whatever is inside. Contrast this with concrete and steel buildings which serve as a fire retardant, minimizing property damage and, mostly importantly, loss of life.

How to Quantify the Risk of Mass Timber

Mass timber is a new construction material. It involves new technologies and brand-new construction methods. This presents a problem for insurers as their main job is to accurately assess and insure against threats. Many in the insurance industry feel that not enough time has elapsed to gather data to accurately quantify all the risk factors.

Insurers also consider threats posed by water damage from firefighting, flooding, and extreme weather. In fact, water damage—not fire—is the biggest consideration when determining insurance rates.

Following water damage, insurers also consider fire, natural disasters, accessibility to first responders, and the cost of repair. Thanks to its long history as a construction material, masonry and concrete structures are easy to assess. Mass timber, on the other hand, is still new. The process to verify the structural integrity of a damaged mass timber building is very expensive, laborious, and sometimes questionable, making it difficult to quantify the potential risk.

Let’s take a look at our second case study. In this study, two $120 million buildings compared course of construction insurance rates between concrete/masonry construction and mass timber construction. The difference in rates was astronomical.

- The concrete/masonry project paid a total of $237,600 over the course of 18 months

- The mass timber building shelled out $1,080,000 to insure their construction project

In other words, the concrete/masonry project saved $842,400 in insurance costs.

Often, insurers are hesitant to assume the risk for the entirety of a mass timber building project and will offer only partial coverage. As a result, many mass timber projects require multiple insurers which drives costs up.

For Savings and Security, Choose Concrete Masonry

While many tout the benefits of mass timber, the fact remains that there are many unknowns regarding the risk factors of these buildings. Uncertainty is an unattractive quality to insurers, who require solid data to assess risk probability. As long as this uncertainty exists, the insurance rates of mass timber buildings will be high.

For radically lower insurance costs, greater security, and a host of other benefits, choose concrete masonry for your building projects.

____________________________________________________________________

Information in this article was informed by a 2016 Study of Insurance Costs for Mid-Rise Wood Frame and Concrete Residential Buildings undertaken by Globe Advisors.